how to pay taxes instacart

In August 2022 President Joe Biden signed the Inflation Reduction Act of 2022 into law. Depending on your location the delivery or.

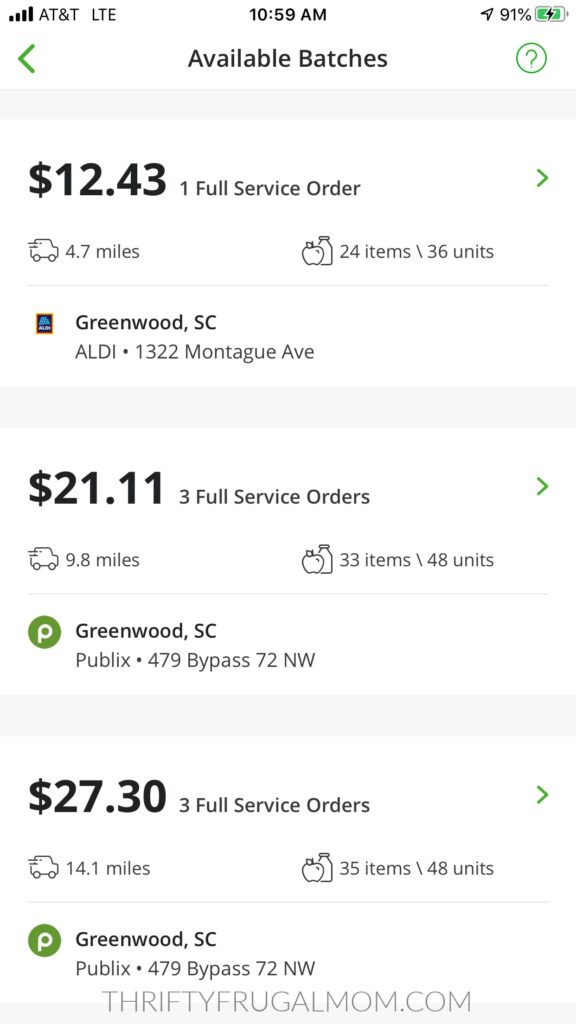

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

To actually file your Instacart taxes youll need the right tax form.

. Rather have a professional prepare your tax return to guarantee you get every deduction youre entitled to so you pay the minimum tax. If you owe more than 1000 in taxes for the year and do not pay taxes quarterly youll be hit with a late payment penalty by the IRS. For Instacart to send you a 1099 you need to earn at least 600 in a calendar year.

To pay your taxes youll generally need to make quarterly tax payments estimated taxes. Read all you need to know about taxes. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store.

At the same point the minimum pay for delivery-only drivers was 5 per. To add a payment on the Instacart website At the top left click the 3 horizontal lines Click Account settings Click Payment methods Click Add next to the payment method. You dont get the QBI deduction.

For most Instacart shoppers you get a deduction equal to 20 of your net profits. Youll need to pay estimated taxes every quarter for the expected taxes youll owe. You will need a 1099 for each app that you delivered.

That means youd only pay income tax on 80 of your profits. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. If you do Instacart for extra cash and have a W-2 job.

Tax tips for Instacart Shoppers. These pay stubs are used while filing taxes applying updating loans and information and applying for a mortgage or low-income benefits. Using the 1099-NEC form independent contractors from Instacart file their taxes.

One of its provisions was a minimum. The IRS establishes the. Learn the basic of filing your taxes as an independent contractor.

Previously the shoppers used. Were here to help you navigate through federal state and FICA taxes. Pay Instacart Quarterly Taxes.

Instacarts platform has an account summary and will let you know what you made in a given year. As an independent contractor you must pay taxes on your Instacart earnings. If you earned at least 600 delivery groceries over the course of the year including base pay.

Depending on your location the delivery or service fee. Published on Tue October 4 2022 944AM PDT. If you have any 1099-specific questions we recommend reaching out to.

To file your quarterly taxes youll need to. For one thing your tax situation will actually vary depending on whether youre an in-store. To figure out your projected quarterly taxes multiply your entire tax burden for the year including freelance.

So you wont include IC on your 2020 tax return as you stated that you didnt work for IC then. To file your taxes just click on. 1040ES is the form that you send in with your tax payment quarterly.

Keep in mind that the IRS gets an exact copy of your. How taxes work for Instacart shoppersInstacart taxes can get pretty complicated. As of July 14 2022 the minimum pay for full-service drivers ranged between 7 and 10 per batch.

Instacart taxes can be overwhelming and confusing. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

When Does Instacart Pay Me A Contracted Employee S Guide

Is This How Instacart Sends Out 1099s Or Is This A Scam R Instacartshoppers

Taxes Doordash Uber Eats Grubhub Instacart Contractors Page 3 Of 4 Entrecourier

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

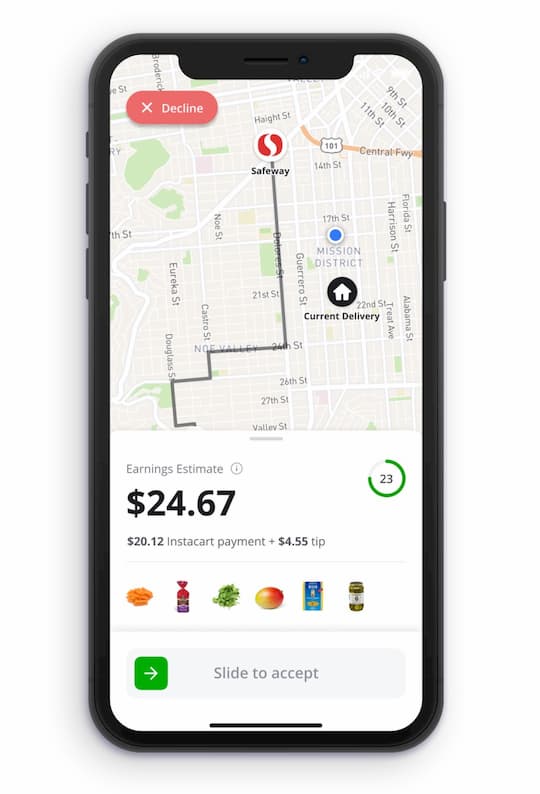

Instacart Driver Review Get Paid To Shop And Deliver Groceries

How To Order On Instacart With Pictures Wikihow Life

Shipt Vs Instacart 2022 Which Side Hustle Is Best For Drivers

How Instacart Calculates Heavy Pay On A Batch

Stop Ironing Shirts Instacart Shopper Stop Ironing Shirts

Drive With Instacart In Mobile Instacart Com

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

How To File Your Taxes As A Food Delivery Driver Grubhub Doordash Instacart Dumpling Etc Contact Free Taxes

1099 Taxes For Gig Workers Explained Expert Advice For Independent Contractors 2020 Instacart Youtube

What You Need To Know About Instacart 1099 Taxes

Instacart In California Every Other State R Instacartshoppers

Instacart Driver Review 10k As A Part Time Instacart Shopper

Instacart S Paying Out 96 Cents An Hour But Doordash Has Them Beat Payup